Key takeways

- RPA bots can include several rule-based tasks and recurring processes in bookkeeping.

- Technologies such as AI and ML make the system capable of learning from the processes to enhance the outcomes.

- Automation technologies enhance the speed, accuracy, and efficiency of bookkeeping. Bots also reduce labor requirements and costs.

- Bookkeeping can be managed seamlessly by man-machine collaboration. Bots automate repetitive tasks while humans play a vital role in critical areas of bookkeeping.

- Automation of bookkeeping by leveraging emerging technologies is a must for businesses as it boosts productivity and provides a competitive edge in a dynamic marketplace.

Automation has made a foray in nearly all sectors in some way or the other. Technologies like Robotic Process Automation(RPA) are being used for automating rule-based processes. In other processes that require intelligent automation, Artificial Intelligence(AI) and Machine Learning(ML) are used along with RPA.

The financial sector has several rule-based, repetitive processes that can be easily automated using RPA. Automation of processes such as account reconciliations, invoice processing, bookkeeping, etc. eliminate human errors and enhance speed and accuracy.

The focus of this article is on automated bookkeeping.

Automated bookkeeping is streamlining the bookkeeping process by leveraging technologies like RPA, AI, and ML.

Why should Bookkeeping be Automated?

Manual bookkeeping has several shortcomings that automation overcomes.

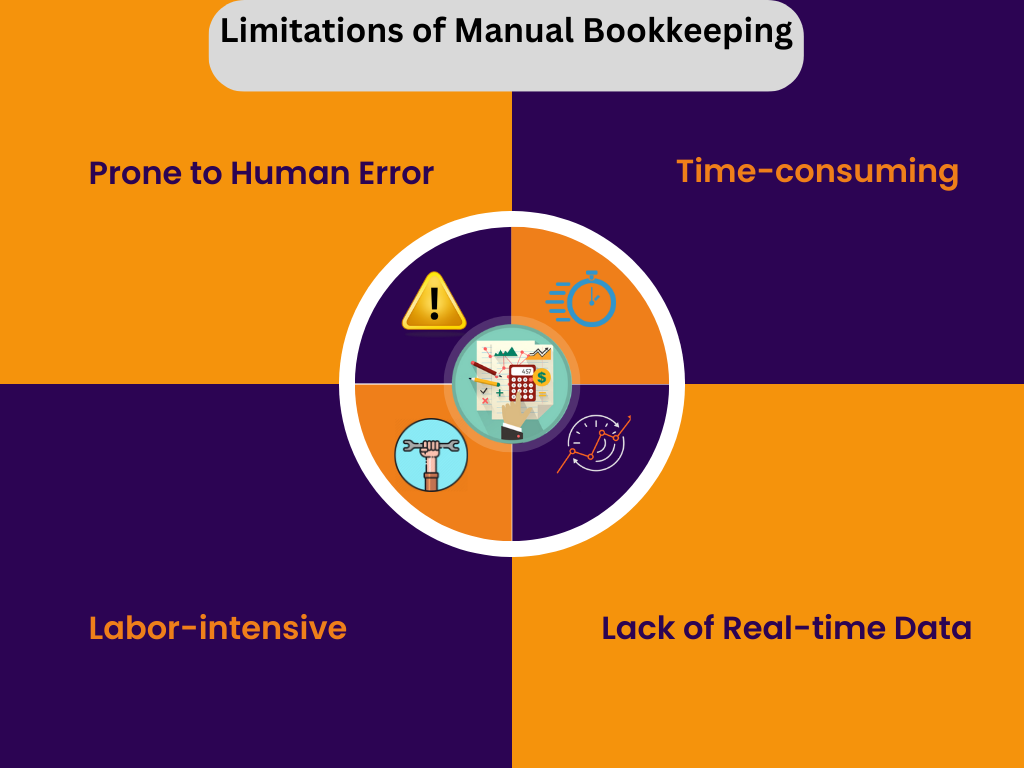

Following are some Limitations of Manual Bookkeeping:

1. Prone to Human Error

Bookkeeping entails tasks like making numerous entries, tallying data, making calculations, and more. In traditional bookkeeping, all these tasks are done manually. Performing all these tasks manually makes bookkeeping prone to errors. Automated bookkeeping eliminates human intervention in repetitive tasks. This minimizes errors and enhances the accuracy of bookkeeping processes.

2. Time-consuming

Manual bookkeeping is a slow process because it is dependent on the speed at which the accountants operate. It is a well-known fact that automation can perform the task that is performed by humans in days in a matter of minutes. Better speed of bookkeeping increases productivity.

3. Labor-intensive

The bookkeeping function requires several tasks to be performed. Each of these tasks requires high accuracy. So, several finance professionals work on these tasks for making entries, checking and rechecking data, etc. This increases the human resource requirement and costs. Automation can perform most of these tasks independently thereby reducing the number of professionals working on these tasks. It makes the staff free so that they can perform tasks that require human intervention.

4. Lack of Real-time Data

In manual bookkeeping, the bookkeeper needs to update the accounts. Accounting professionals can access this data only after it has been updated. On the other hand, automation bots update the data as soon as it is available. This provides accountants with real-time data.

Based on these facts, we can conclude that automation enhances the speed, accuracy, and efficiency of the bookkeeping function. Besides, it also reduces labor requirements and costs. All these benefits increase the efficacy of the bookkeeping function.

Bookkeeping includes several rule-based, recurring processes that can be easily automated by RPA bots. Technologies such as AI and ML make the system capable of learning from the processes to further enhance the outcomes.

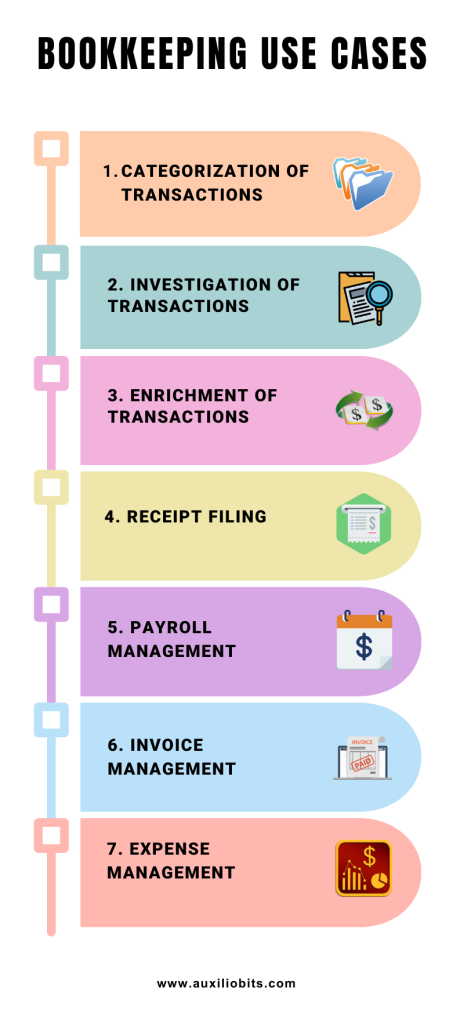

Following are some Bookkeeping tasks that can be Automated:

Categorization of Transactions

All the financial transactions are categorized. In legacy systems, this task was performed by accountants. But when ML is used for the categorization of transactions, it saves time because it can consider numerous variables at the same time. It streamlines the process and enhances accuracy.

Investigation of Transactions

ML verifies transactions and validates them. This verification provides feedback about unknown transactional activities and uncategorized transactions.

Enrichment of Transactions

Accountants manage several datasets. However, without context, it is difficult to comprehend the information conveyed by a data set. Machine Learning audits provide insights into the latest and the oldest transactions. These insights help accountants in understanding the data easily and acting on it.

Receipt Filing

For organizations that provide their employees with corporate credit cards or reimburse their expenses, receipt filing can be a cumbersome task. Automation of receipt filing requires the employees to scan and upload images of their receipts. Automation software extracts the relevant information and updates this data on the accounting software. Certain bookkeeping automation bots trigger the payment to the employee who uploads the receipt.

Managing Payroll

RPA bots calculate the wages and manage deductions seamlessly. The payroll software records all elements of an employee’s compensation such as gross pay, salaries, commissions, bonuses, and more. It also manages the tax implications for the pay of each employee. Automated payroll also provides employees easy access to pay information.

Managing Invoices

Automated bookkeeping streamlines the management of payables and receivables. RPA bots can collect information about recurring payments that include both vendor and customer invoices.

Expense Management

Expense management can be a tedious and time-consuming task. Automation bots simplify the process. ML extracts relevant data from receipts and compares it with bank/credit card transactions and enters it into accounting software. ML learns from the way the data is organized and applies it to similar transactions to categorize data.

Automation simplifies bookkeeping to a large extent. However, it cannot completely replace humans and function independently. To manage bookkeeping seamlessly, man-machine collaboration is required. Bots automate repetitive tasks but humans have a role to play in critical areas of bookkeeping.

Role of Accounting Professionals in Bookkeeping:

- Bookkeeping software functions according to the algorithms coded into it. Therefore, the development of the software requires professionals with thorough knowledge of finance.

- Automation cannot manage ambiguous tasks. So, human intervention is required.

- Accounting professionals determine the level of detail required for charting the accounts.

- Although automation bots minimize several errors in the process, certain errors may go unnoticed. Therefore, accounting professionals need to review the records to fix errors before month-end closing.

Successful implementation of automation requires a strategic approach and careful planning.

How to Automate your Bookkeeping?

1. Identify your Goals

Establish the reason for automating bookkeeping.

2. Define your Budget

Allocate the amount you want to invest in automation.

3. Check the Level of Automation in the Organization

Bookkeeping is an interdisciplinary function. Therefore, you need to find out the extent to which automation has been adopted for other functions in your organization. Also, find out the automation tools used.

4. Identify the Processes to be Automated

Not all bookkeeping processes can be automated. Consult an automation expert at Auxiliobits to assess what processes can be automated.

5. Assess if the Existing Framework Supports Automation

It may not be possible to integrate automation in organizations that are managing their bookkeeping with obsolete technologies. Hence, it is necessary to assess if automation can be integrated with your existing framework.

6. Choose the Best Automation Software

There are several software tools available for the automation of bookkeeping. Choose one that includes all the features required to fulfill the needs of your business. Also, make sure that you choose a tool that is within your allocated budget and meets the quality standards.

Automating the bookkeeping function of an organization can be a daunting task. A professional can guide you and help you select the best automation tool for your business.

Auxiliobits is one of the leading automation companies that provides automation software customized to the needs of clients.

Why Auxiliobits?

- We develop customized automation bots to manage bookkeeping for your business.

- Our professional team develops automation software that seamlessly integrates with your existing systems.

- Our expert developers have years of experience in developing automation bots for businesses.

- We leverage AI and human expertise to manage all bookkeeping processes.

- Our AI-based automation software ensures that you get continuous accounting and immediate access to reports.

- We use automated transaction syncing to update your books every day.

- Our automation solutions ensure that your bookkeeping is accurate and GAAP compliant.

Wrapping Up

While many businesses have realized the benefits of automated bookkeeping and are adopting it, some are still skeptical, especially regarding the cost factor. No doubt automation requires a high initial investment. But its benefits easily justify the investment. Automation streamlines bookkeeping. An automated bookkeeping function is not dependent on accountants and can function, to an extent, even in their absence. Automation software works seamlessly for years. This reduces the future expenses of the business. Automation of processes by leveraging emerging technologies is a must for businesses as it boosts productivity and provides a competitive edge in a dynamic marketplace.

Find out more about how we automate processes to enhance efficiency in our upcoming blogs.